I have decided to dust off my soapbox. We have been having some interesting conversations at work the last couple of weeks and I have decided to comment on them. For starters, for those of you that don’t know, I have worked as an oilfield machinist since 1982. That gives me 39 years in this industry, watching the rise and fall and rise again of oil. The oil pendulum has always swung back and forth with the volatility of oil prices and as the commodity has fallen in and out of favor with politicians at both the state and federal level and, of course, various environmental groups. During my time in the industry, many of the politicians and virtually all of the environmental groups have been trying to kill the industry, with varying degrees of success.

The state of California, where I live, has been trying to kill the industry with special vigor since the election of our so-called governor, Gavin Newsome. This makes almost no sense in light of the following figures. As of 2017 the industry’s total economic impact in California was larger than the total economies of 15 states. The oil industry directly employed almost four hundred thousand people in the state. A total of 1.7 million people were indirectly employed in peripheral industries such as transportation, warehousing, manufacturing, and agriculture to name just four. These jobs totaled 8.4% of the states GDP. And the industry contributed more than $26 billion in state and local tax revenues and another $28 billion in sales and excise taxes in that year alone. Banning, not restricting but actually banning, the oil industry in the state of California is akin to killing the goose that laid the golden egg. When that happens, where do two million newly unemployed people go for work? Where do the billions of dollars in tax revenue come from to support a state that is already struggling financially?

For decades California has all but banned offshore drilling. This, despite the fact that there are an estimated 4 to 6 billion barrels of recoverable oil and another 5 to 7 trillion cubic feet of natural gas per 1996 estimates. Lately, the State has taken to trying to eliminate the practice of fracking and has made the permitting process for new wells even more convoluted. The Kern County Board of Supervisors fights the State mandate at every turn, currently threatening lawsuits due to the state’s arbitrary enforcement of a fracking ban not due to take effect for another two years. At one time ARCO, Getty Oil, Union Oil, Occidental Petroleum, and Chevron were all major players in the California oil landscape. Now, all that is left is Chevron. And Chevron has been slowly shifting their operations to Texas and will probably soon be gone as well.

In spite of these attempts to kill it, Kern County is still the third largest oil producing county in the United States. But the emphasis here is shifting, however slowly. Fewer new wells are coming on-line as the number of drilling permits is reduced every year. We have seen the effects in our own company. At one time we employed almost 80 people. At last count we were down to 25, as we are simply seeing less work coming through the doors. It’s a competitive environment as we are up against several other local companies manufacturing tools and equipment for the industry with a smaller pie being divvied up between us. The emphasis now is on capping wells and taking them offline. The state has to strike a delicate balance in this regard. The operators, especially the smaller operators, need income from producing wells so they can afford to cap other wells, otherwise you end up with a phenomenon known as orphan wells. But let there be no mistake, the ultimate goal is to eliminate oil production in the State as an industry.

There seems to be little regard for the financial impact this will have on California. Kern County, in particular, could be devastated as the two largest industries have always been oil and agriculture. We seem to have two interesting phenomena at play within the County. Kern is scrambling to replace the oil industry and is moving to become more of a logistics and warehousing center. This makes a lot of sense due to the central location of the Imperial Valley to the entire West Coast, the low cost of warehousing, and the accessibility of a local airport. Unfortunately, in terms of pay, those jobs can’t compare to the oil industry. In peak times a rig hand with nothing more than a high school diploma could easily make six figures. Those jobs will disappear, along with the lesser paying, though still relatively high-income jobs in the manufacturing sector. This means fewer local residents being able to afford to purchase a new home leading to a larger number of renters. This is coupled with an interesting phenomenon that has seen large numbers of home buyers migrate to the Central Valley from Los Angeles and the Bay Area as they find they can work remotely. The Central Valley has always had much more affordable housing then those areas and these newcomers are used to paying exorbitant real estate prices and therefore, have deeper pockets. This has contributed to a run up in housing prices. Earlier this year the median price for a house in Bakersfield went above $300,000 for the first time in history. The influx of buyers has further stressed a housing market that was already facing an inventory shortage as many of these potential buyers are simply renting until they can find a house to buy. This has caused historically low vacancy rates. This will probably continue until supply can catch up with demand. There simply isn’t enough housing to go around at this time. To put it simply if, for some reason, the sale of new houses was abruptly stopped until the houses already listed in the market were sold, we would run out of inventory in about 3 weeks. Were this to happen in a ‘normal’ market, it would require three or four months to run out of inventory. That is how crazy this market is.

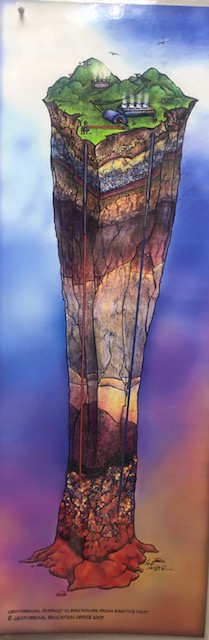

Enough about real estate and the state of the oil industry. The thing I found interesting in these conversations, is a discussion we had regarding lithium. Lithium is one of the prime components of car batteries and of course the push now is to go all electric. According to my research, one third of the world supply of lithium can be found around the Salton Sea, located in south central California, near the Mexican border. That area is considered geologically ‘hot’ and there are a number of geothermal power plants located on both sides of the border. To the uninitiated, geothermal power is one of those ‘green’ power sources (along with wind and solar), that produces electricity via steam. A geothermal well is much like an oil well. It is drilled down into the steam table to tap into the super-heated steam produced in underground water reservoirs. This steam is pumped to the surface and run through a turbine to create electricity. This is an exchange of energy which results in the steam cooling and condensing out as water, which is then recycled back into the well.

A byproduct of these power plants is lithium, contained in mineral deposits that are pumped out of these wells. The problem, it seems, is there has not been a cost-effective way to extract the lithium from the other minerals. Apparently that problem has been resolved somewhat. Like any new technology or process, one would expect that, as time goes on, more cost-effective ways of extracting the lithium from these mineral salts lie just beyond the horizon. This suggests that in the near future there will be a big play for lithium in that part of the State. Possibly replacing oil as a prime energy source, temporarily, I believe. As proof of this, there are a dozen geothermal power plants in the area. Of those 12 power plants, 11 of them are owned by Berkshire Hathaway, Warren Buffett’s company. The 12th plant, apparently, simply did not want to sell to Mr. Buffett when he came knocking at their door. Very quietly, Bill Gates and Jeff Bezos are also investing in the area. And, of course, Elon Musk and Tesla have ties there as well. General Motors is also investing heavily in the lithium play. So, you have four of the richest individuals on the planet and one of the largest automobile manufacturers all looking at the Salton Sea as a source of lithium. Do you suppose it would be an area that might have some good investment potential?

Geothermal wells have been drilled in that area since the 80s, but the lithium play is something new and it could kick off a mining boom not unlike some of the large gold rushes in the past. Think California in 1849, or Alaska at the turn of that century. We are talking about small towns along the California/Mexico border. Calexico on the Mexican side and Calipatria, El Centro, and Palm Springs on the California side. I mentioned Paul springs, even though it isn’t particularly close to the border as compared to those three other towns, because it is a resort town. It would seem to be perfectly positioned to benefit from the jobs and income being generated in these potential lithium operations.

Drilling a geothermal well is very similar to drilling an oil well and uses many of the same components. Amazingly, there is no infrastructure in that area. Pretty much anything they use in these wells comes out of Bakersfield. Sometimes we are talking about a simple $300 or $400 part that has to be special delivered down there, which can add anywhere from $1000 to $1500 to the cost. They don’t mind paying the extra since the alternative is to have a rig shut down at a cost of potentially tens of thousands of dollars. I think at some point someone with a little foresight and some financial backing is going to set up a machine shop/warehouse down there and take advantage of the coming boom. Of course, if you take a historical look back at the old gold rushes it wasn’t the miners that got rich. It was the guy that sold them the picks and the shovels or the owners of the saloons, the casinos, and the brothels.

Without a doubt oil is the number one energy source in this country. Perhaps the largest consumer of hydrocarbons, otherwise known as oil, is the internal combustion engine. Approximately 40% of every barrel of oil produced goes into the production of gasoline. As recently as 2014 the price of oil was over $100/bbl. Then the pendulum swung again, and the bottom dropped out of the oil market, driving prices to less than $20 a barrel. This has left the industry in a nearly decade long slump. The current price rests at around $70/bbl with talk of $100/bbl oil prices not far away. That would seem to suggest another swing of the pendulum to an oil boom. That possibility seems especially true when you consider much of the rest of the world still lags behind the United States and industrialized Europe. Just because we’re all driving electric cars, and using solar panels, and wind turbines doesn’t make that so elsewhere. If the current political powers have their way, much of that oil boom will most definitely bypass California and possibly the United States as a whole. There is a political push in this country, via the current administration, to become more reliant on oil produced in the Middle East. If you were raised in the 70s and 80s this may sound very familiar. Sadly, those who do not learn from history are condemned to repeat it. The last time this country was dependent on oil from the Middle East things did not turn out well. It is one of the reasons the United States shifted to become oil independent. This country has the largest oil reserves in the world. That means there is no reason for us to depend on anyone else for oil. Even now we import slightly more oil than we export. That is out of balance with reality.

Anyway, I am going to make a prediction. Take it for what it is worth. I foresee a pendulum swing to another oil boom in the next few years. This boom will run neck and neck with the push for electric cars. The problem with going all electric at this point is that manufacturing is outpacing infrastructure. What I mean is battery technology is not quite there yet. These batteries last about five years. With 300 million electric cars on the road that means 60 million batteries, made from hazardous materials, are going into landfills every year from then on out. Number one, battery life has to be increased. Number two, we have to figure out a way to safely and cleanly dispose of used batteries. Number three, we have to either increase the productivity of the current batteries or we have to build additional sources of electricity. Electricity, especially if you live in the southwestern part of the United States, is at a premium. We have rolling blackouts and wildfires created by the power grid. What’s going to happen with the increased electrical demand generated by 300 million electric cars on the road? There simply is not going to be enough electricity to go around. There barely is now. And, with all that increased electrical demand, prices of electricity will literally go through the roof. So, there it is folks. The current administration seeks to abolish the internal combustion engine and replace it with electric cars before resolving these three issues. Typical political non-think, to paraphrase George Orwell.

What I think will happen, probably over the next ten or fifteen years, is electric cars will phase out the internal combustion engine putting an end to a short, penultimate oil boom. Then, all the issues that I have listed above will come into play and create havoc. I think, as we approach the middle of this century, there will be one last swing of the pendulum, creating a short oil boom, as utilities and the automotive industry scramble to create infrastructure to adequately meet the demand. This will happen despite Washington’s own best efforts to screw it up. I believe only when all this comes to pass, and only then, will we see oil finally disappear as a major energy player. To be sure, demand for oil will still be around for another 100 years or so, as it is used in so many other areas. But its’ time as an energy giant is quickly drawing to a close, to be replaced by electricity with a main component of lithium. The clock is winding down, the pendulum coming to a halt.

Hope you found this interesting friends. That area of California may be worth a close look for its’ investment potential. Remember where you heard it first. Make sure you leave your comments. They are always welcome. As always, until next week, remember to swing for the fences.